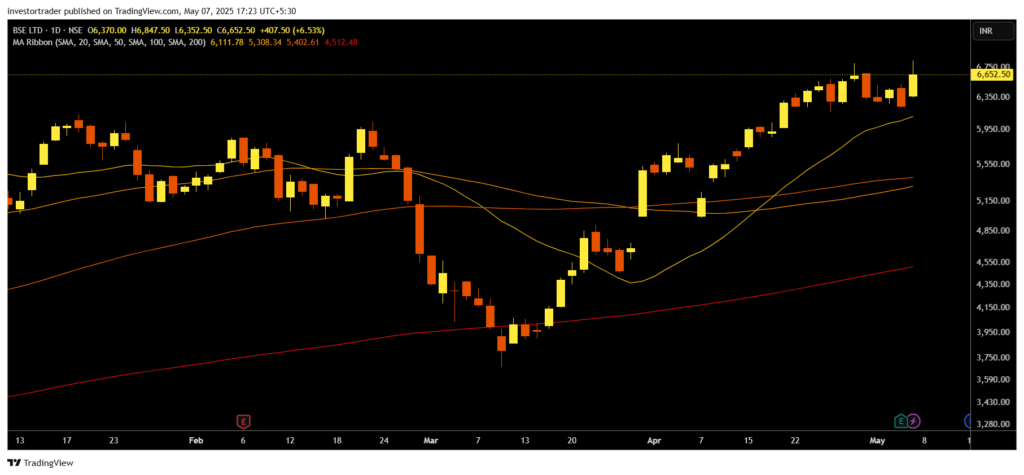

BSE Stock Technical Analysis: A Strong Buy Signal

Date: May 7, 2025

The technical analysis of BSE stock reveals an overwhelmingly bullish sentiment, with key indicators pointing to a Strong Buy signal. Here’s a breakdown of the key metrics and what they signify for investors and traders:

Technical Indicators Overview

- Overall Rating: Strong Buy

- Buy: 7

- Neutral: 3

- Sell: 0

Key indicators driving this bullish sentiment include:

- RSI (14): At 65.098, this indicates a healthy uptrend, with buying momentum intact.

- MACD (12,26): A strong value of 355.43 suggests a positive divergence, further confirming bullish strength.

- ADX (14): At 40.2, this reflects a strong trend direction, favoring buyers.

- CCI (14): With a value of 128.3487, the commodity channel index shows the stock is trading well above its mean, signaling buying interest.

- Williams %R: At -17.984, this indicates the stock is in overbought territory, a potential area to monitor for short-term corrections.

- ATR (14): With lower volatility reflected in 281.3929, the market is relatively stable, favoring trend-following strategies.

Moving Averages

- Overall Rating: Strong Buy

- Buy: 12

- Sell: 0

The alignment of short- and long-term moving averages suggests a strong upward trajectory:

- Short-Term Averages (MA5, MA10): Consistently bullish with values like MA5 (Simple: 6406.70; Exponential: 6468.38) indicating recent price strength.

- Mid- and Long-Term Averages (MA50, MA100, MA200): Firmly bullish, showing sustained buying activity over extended periods. MA200 (Simple: 4512.57; Exponential: 4649.93) highlights robust support levels.

Pivot Points Analysis

Pivot points signal potential support and resistance levels:

- Classic R1: 6443, providing the first key resistance level.

- Fibonacci R2: 6522.77, indicating further upward potential.

- Woodie’s R2: 6619.38, suggesting strong resistance for the current trend.

Investor Outlook

The technical landscape for BSE stock strongly supports a bullish stance. With zero sell signals and consistent upward momentum across multiple timeframes, this stock is an attractive option for investors seeking growth opportunities. However, the overbought Williams %R and neutral STOCHRSI (14) readings warrant caution for short-term traders, as minor corrections may occur.

Disclaimer

This analysis is for educational purposes and does not constitute financial advice. Investing in the stock market involves risks, and past performance is not indicative of future results. Please consult a certified financial advisor before making investment decisions.